In the article, “Navigating The Fusionex Winding Up Process: What You Need To Know,” we will explore the intricacies of the Fusionex winding up process and provide you with essential information to navigate through it. As a big data expert, it is essential to have a clear understanding of this process to ensure smooth operations and protect your business interests. By following proper H1, H2, and H3 tag formats, along with incorporating engaging content and visual aids such as videos and images, this article aims to provide you with the comprehensive knowledge required to successfully navigate the Fusionex winding up process.

Understanding the Fusionex Winding Up Process

When a company goes into financial distress, it may result in the need for the Fusionex winding up process. This process involves the liquidation of the company’s assets, settlement of debts, and ultimately the closure of the business. It is important for stakeholders to have a comprehensive understanding of this process, including its implications and alternative options.

What is the Fusionex Winding Up Process?

The Fusionex winding up process is a legal procedure that leads to the dissolution of a company. It occurs when a company can no longer meet its financial obligations and is unable to continue its business operations. During this process, the company’s assets are sold off to pay off its debts, and the remaining funds are distributed amongst the company’s creditors.

When does the Fusionex Winding Up Process occur?

The Fusionex winding up process occurs when a company is insolvent, which means it is unable to pay its debts as they become due. It can also be initiated voluntarily by the company’s directors when they believe it is in the best interest of the company and its stakeholders. Additionally, the winding up process can be initiated by creditors who are owed a significant amount of money and believe they have no other recourse to recover their funds.

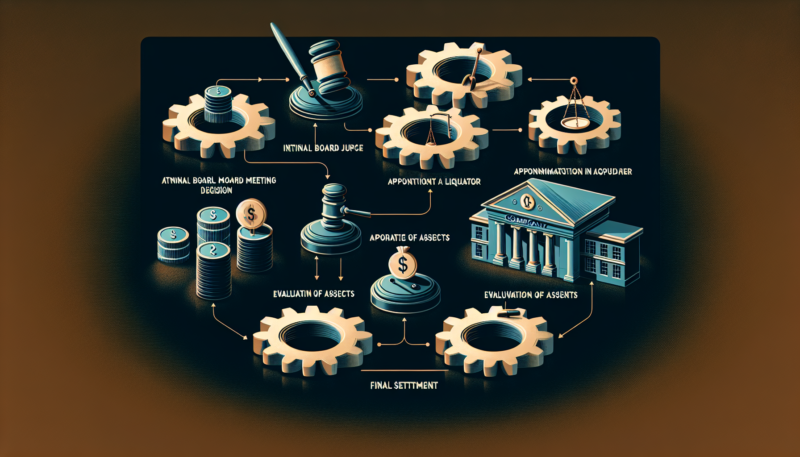

The Different Stages of the Fusionex Winding Up Process

The Fusionex winding up process consists of several stages that must be completed in order to dissolve the company. These stages include the appointment of a liquidator, the realization of assets, the settlement of debts, and the distribution of funds to creditors. Throughout this process, various legal requirements must be met, and stakeholders must actively participate in order to ensure a smooth and efficient winding up process.

Key Players in the Fusionex Winding Up Process

Several key players are involved in the Fusionex winding up process, each with their own roles and responsibilities. These key players include the liquidator, the company directors, and the creditors and shareholders.

The Liquidator

The liquidator is a licensed professional who is appointed to oversee the winding up process. Their primary duty is to collect and realize the company’s assets, settle its outstanding debts, and distribute the remaining funds to creditors. The liquidator also has a responsibility to investigate and report on the company’s affairs, ensuring that any wrongdoing is properly addressed.

The Company Directors

The company directors play a crucial role in the winding up process. They are responsible for initiating the process, either voluntarily or through a court application. Throughout the process, directors must cooperate with the liquidator, provide necessary information, and act in the best interest of the company and its stakeholders.

Creditors and Shareholders

Creditors and shareholders are also important players in the winding up process. Creditors are individuals or entities who are owed money by the company and have a vested interest in ensuring their debts are repaid. Shareholders, on the other hand, are individuals who own shares in the company and may be impacted by the winding up process. Both creditors and shareholders have the right to participate in creditor meetings and vote on important decisions during the winding up process.

Implications of the Fusionex Winding Up Process

The Fusionex winding up process has significant implications for various stakeholders involved. These implications can be categorized into three main areas – the effect on employees, the impact on suppliers and customers, and the legal consequences for the company directors.

Effect on Employees

When a company goes into liquidation, it often leads to the loss of jobs for employees. Employees may experience uncertainty, financial hardship, and a sense of instability. However, there are legal protections in place to safeguard employee rights, including the payment of outstanding wages and statutory redundancy pay.

Impact on Suppliers and Customers

Suppliers and customers can also be heavily impacted by the winding up process. Suppliers may face non-payment for goods or services provided, while customers may no longer have access to products or services they relied on. It is important for suppliers and customers to understand their rights and obligations, and to communicate with the liquidator to minimize any potential losses.

Legal Consequences for the Company Directors

Company directors may face legal consequences if they are found to have acted improperly or negligently leading up to the winding up process. Directors have a duty to act in the best interest of the company and its stakeholders, and failure to fulfill these duties may result in personal liability or disqualification from acting as a director in the future.

Steps to Take When Facing the Fusionex Winding Up Process

Facing the Fusionex winding up process can be daunting, but there are proactive steps that stakeholders can take to safeguard their interests.

Seeking Legal Advice

It is essential to seek legal advice from professionals who specialize in insolvency and corporate law. They can provide guidance on the legal rights and obligations of stakeholders, as well as advice on alternative options to the winding up process.

Communication and Negotiation

Open and transparent communication is key during the winding up process. Engaging in constructive dialogue with the liquidator, creditors, and other stakeholders can help to minimize disputes and reach favorable agreements. Negotiation may involve discussing repayment terms, alternative payment arrangements, or potential business restructuring.

Understanding Your Rights and Obligations

Stakeholders should take the time to educate themselves on their rights and obligations during the winding up process. This includes understanding the relevant laws and regulations, participating in creditor meetings, and seeking advice on how to protect their interests.

Alternative Options to the Fusionex Winding Up Process

While the winding up process may be inevitable for some companies, there are alternative options that can be considered.

Company Voluntary Arrangement (CVA)

A Company Voluntary Arrangement (CVA) is a legally binding agreement between a company and its creditors to repay debts over a fixed period of time. This allows the company to continue trading while repaying its debts and can provide a viable alternative to the winding up process.

Administration

Administration involves the appointment of an insolvency practitioner to take control of the company’s affairs and assets. The goal of administration is to rescue the company as a going concern or achieve a better outcome for creditors than would be possible through the winding up process.

Restructuring and Reorganization

In some cases, companies may be able to avoid the winding up process by implementing a restructuring or reorganization plan. This may involve downsizing, refinancing, or finding new investment opportunities to improve the company’s financial position.

The Role of the Liquidator in the Fusionex Winding Up Process

The liquidator plays a critical role in overseeing the Fusionex winding up process. They have specific duties and responsibilities that they must fulfill throughout the process.

Duties and Responsibilities of the Liquidator

The liquidator’s duties include collecting and realizing the company’s assets, conducting investigations into the company’s affairs, settling debts, and distributing funds to creditors. They must act impartially and prioritize the interests of creditors while complying with legal obligations.

Distribution of Assets

The liquidator is responsible for distributing the proceeds from the sale of the company’s assets to its creditors. This distribution is made in accordance with the priority of creditors, as outlined in insolvency laws.

Reporting and Communication

The liquidator is required to maintain accurate records and prepare reports detailing the progress and outcome of the winding up process. They must also communicate with stakeholders, including creditors and shareholders, to keep them informed throughout the process.

Protecting Your Interests in the Fusionex Winding Up Process

Stakeholders can take steps to protect their interests during the Fusionex winding up process.

Securing Your Employment Rights

Employees should familiarize themselves with their employment rights and ensure they receive any outstanding wages or statutory redundancy payments they are entitled to. Seeking legal advice can help employees understand their rights and take appropriate action.

Maximizing Recovery as a Creditor

Creditors should actively participate in the winding up process to maximize their recovery. This may involve lodging a formal proof of debt, attending creditor meetings, and engaging in negotiations with the liquidator.

Protecting Shareholder Interests

Shareholders should keep themselves informed and actively participate in the winding up process to protect their interests. This may involve voting on important decisions, seeking legal advice, and exploring potential avenues for recovering their investment.

Challenges and Pitfalls in the Fusionex Winding Up Process

The Fusionex winding up process can be fraught with challenges and pitfalls that stakeholders must navigate.

Complex Legal Procedures

The legal procedures involved in the winding up process can be complex and technical. It is important to engage professionals with expertise in insolvency law to ensure compliance with legal requirements and to avoid any potential pitfalls.

Disputes and Litigation

Disputes and litigation can arise during the winding up process, particularly if stakeholders have conflicting interests. It is important to engage in open and constructive communication to minimize the risk of disputes escalating into costly legal proceedings.

Financial and Operational Challenges

Managing the financial and operational challenges that arise during the winding up process can be demanding. Stakeholders must carefully manage cash flow, maintain comprehensive records, and make informed decisions to navigate these challenges successfully.

Case Studies: Successful Navigations of the Fusionex Winding Up Process

Examining case studies of companies that have successfully navigated the Fusionex winding up process can provide valuable insights and lessons.

Company A: A Story of Recovery and Transformation

Company A faced financial difficulties but implemented a comprehensive restructuring plan that allowed it to emerge stronger and more sustainable. By engaging in open communication with creditors and shareholders, the company was able to negotiate favorable repayment terms and secured new investment opportunities.

Company B: Avoiding Liquidation through Negotiation

Company B faced the prospect of liquidation but engaged in proactive negotiation with its creditors. Through open and transparent communication, the company was able to reach mutually beneficial agreements, including extended repayment terms and revised contractual obligations.

Company C: Lessons Learned from a Challenging Winding Up Process

Company C experienced a challenging winding up process, characterized by disputes, litigation, and financial struggles. By reflecting on the challenges faced and seeking professional advice, the company was able to learn valuable lessons and implement measures to avoid similar situations in the future.

Conclusion and Key Takeaways

Understanding the Fusionex winding up process is essential for stakeholders involved in financially distressed companies. By taking proactive steps, seeking professional advice, and exploring alternative options, stakeholders can navigate the process more effectively. Protecting interests, maximizing recovery, and maintaining open communication are key elements to achieving a favorable outcome in the winding up process.